Stop Wage Garnishment in Virginia - An Overview

Ideally, you'll pay back the whole balance in a relatively brief length of time with no far too much money hardship on your part.

It provides you a step by step instructions. My individual bankruptcy was discharged with none troubles. I might entirely suggest them to anybody who is wanting submitting personal bankruptcy.

Should the creditor obtains a wage garnishment purchase, there are many stuff you could do to stop wage garnishment in Virginia.

Summary: Wage garnishment is the last resort creditors use to receive their money from debtors. In spite of obtaining this selection, West Virginia garnishment guidelines still make the process far more favorable to the consumer, limiting garnishment quantities to twenty% of a shopper’s disposable money.

“When you get an IRS letter from the mail, you are inclined to shed loads of rest and from time to time Really don't even open up the envelope!

How much are you able to be garnished? The garnishment laws range by state. You will discover federal regulations that govern wage garnishments much too. Allow’s look at the Virginia wage garnishment laws.

Usually, a creditor are unable to garnish your wages with out first obtaining a money judgment against you. The creditor must file a lawsuit in court and possibly receive a default judgment (an automatic win as you Will not reply to the go well with) or acquire its circumstance.

A lot of creditors would like to get a smaller sum in a very 1-time lump sum payment rather than read this post here the entire amount paid in more compact, periodic payments after a while.

Submitting for bankruptcy in Virginia may perhaps remove a wage garnishment a judgment linked to unpaid personal debt, particularly in These occasions when folks are now residing paycheck to paycheck. There's two frequent purchaser bankruptcies to take into account.

Thankfully, most Lawyers choose payment designs with the legal professional expenses. Some attorneys consider the majority of the Chapter 13 individual bankruptcy you can check here payments from the system.

The creditor must provide notice within the employer or other source of money or financial savings and provide them with copies of your find more information buy and judgment.

Own judgments for healthcare charges, charge card debts, personal loans, and also other unsecured debts slide into your fifth classification. The order with the highest find here priority receives payment very first. If your employer gets two orders While using the same priority, the order obtained very first receives priority.

Though federal law imposes this website restrictions on the amount that could be garnished, Virginia regulation imposes even stricter limitations. Federally, debtors are guarded in that creditors can only garnish a total of 25% of your respective disposable income or 30 instances the federal minimum wage, whichever is considerably less.

A wage garnishment purchase lets creditors to take funds straight from your paycheck. Usually, This really is only attainable following a court docket has entered a judgment. This is how Virginia regulates wage garnishments.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Kenan Thompson Then & Now!

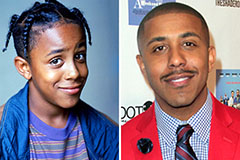

Kenan Thompson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!